The Intrinsic Value Calculator is a script tool designed specifically for the TradingView charting platform. It uses proven valuation methods to automatically estimate a stock’s intrinsic value, allowing users to quickly check the intrinsic value of individual stocks directly from the chart.

What Is Intrinsic Value?

Intrinsic value refers to the true, fundamental worth of an asset or company, derived from fundamental analysis. It is a key indicator used to assess whether a stock, bond, or other asset is overvalued or undervalued. Intrinsic value reflects the discounted value of a company’s future cash flows or its true economic strength, rather than being influenced by market sentiment or short-term price fluctuations. Common methods for evaluating intrinsic value include the Discounted Cash Flow (DCF) model, profitability analysis, and asset valuation.

Warren Buffett places great importance on the concept of intrinsic value, considering it the core of investment decision-making. He believes that intrinsic value represents the present value of the future cash flows a company can generate throughout its lifecycle. Therefore, the key to evaluating intrinsic value lies in understanding a company’s fundamentals, such as profitability, growth potential, debt levels, management quality, industry position, and competitive advantage.

Buffett’s investment philosophy is based on value investing, meaning he only buys companies that are undervalued by the market but have intrinsic values higher than their market prices. He often uses a conservative approach to estimate intrinsic value, ensuring that when he buys a stock, he has a “margin of safety”—where the market price is significantly lower than the company’s true worth—thus reducing investment risk.

How to Calculate Intrinsic Value

To calculate a stock’s intrinsic value, we use two valuation methods: Discounted Cash Flow (DCF) model and Earnings Power model. By taking the average of these two methods, we aim to provide the most accurate estimate of intrinsic value.

- Discounted Cash Flow (DCF) Model

The DCF model estimates the intrinsic value of a company based on its expected future cash flows. These cash flows are then discounted back to their present value to determine the company’s worth today.- The key concept behind DCF is that a company’s value is derived from the cash it can generate in the future.

- The discount rate used in this model is the risk-free rate of return (such as the interest rate on fixed deposits).

- Earnings Power Model

The Earnings Power model evaluates a company’s intrinsic value by comparing its current earnings against other low-risk investment opportunities (such as fixed deposit returns).- This method helps estimate a company’s value based on its current profitability, without relying too much on uncertain future projections.

- By comparing the company’s earnings potential to a low-risk investment, we can determine if it offers a superior return or if a safer investment would be preferable.

By averaging the intrinsic value estimates from these two methods, we provide a balanced valuation approach that accounts for both future growth potential (DCF) and current profitability (Earnings Power model).

Line Chart: Earnings Yield vs. Dividend Yield vs. Fixed Deposit Rate

In addition to automatically estimating a stock’s intrinsic value, this script also plots the stock’s earnings yield, dividend yield and current fixed deposit interest rate. This feature allows users to conveniently compare a company’s profitability with fixed deposit rates, helping investors determine whether buying the stock at its current price is reasonable.

If a company’s earnings yield or dividend yield is significantly higher than the current fixed deposit rate, investing in the stock at its current price is reasonable.

Conversely, if the company’s earnings yield or dividend yield is lower than the fixed deposit rate, then it may be wiser for investors to place their money in a fixed deposit, which offers a safer and higher return.

Earnings Yield (Profitability Measure)

Earnings yield is a key indicator that reflects a company’s current profitability. It is calculated by dividing the company’s Earnings Per Share (EPS) by the current stock price:

- A higher earnings yield suggests that the company generates more profit per dollar invested by shareholders.

- This metric is especially useful when comparing a company’s profitability to other investment options such as fixed deposits, bonds, or other stocks.

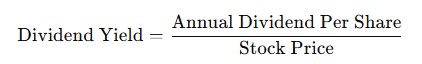

Dividend Yield (Income from Dividends)

Dividend yield measures the annual dividend income an investor receives relative to the stock price. It is calculated as:

- Stocks with high dividend yields are attractive to investors seeking regular income from their investments.

- This metric helps assess how much return an investor earns in dividends compared to other low-risk income-generating options.

Fixed Deposit Interest Rate (Risk-Free Rate)

The fixed deposit rate, also known as the risk-free rate, represents the return an investor can expect from a risk-free investment, such as government bonds or fixed deposits.

This rate serves as a benchmark for evaluating the returns of other investment options, including stocks.

Key Financial Ratios Overview

This tool quickly displays the financial health of individual companies, including important financial ratios such as the R&D ratio, net profit margin, and return on equity (ROE). By using this tool, investors can rapidly evaluate a company’s profitability, liquidity, and financial stability, enabling them to make informed investment decisions.

R&D Ratio

The R&D Ratio is a metric used to compare the efficiency of research and development (R&D) spending among companies within the same industry. It is calculated by dividing R&D expenses by total revenue:

- This ratio reflects a company’s investment in innovation, technology, and product development.

- It helps investors compare R&D efficiency across different companies within an industry.

Warren Buffett’s Perspective on R&D Spending

Buffett prefers companies that do not rely heavily on R&D spending to maintain their competitive advantage. Industries such as consumer goods and utilities often have low R&D costs, yet maintain strong brands, business models, or economic moats.

If a company is overly dependent on R&D to sustain its market position or profitability, Buffett may approach it cautiously. High R&D costs could impact long-term profitability and indicate a lack of stable competitive advantages.

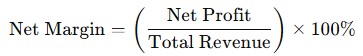

Net Profit Margin (Net Margin)

Net profit margin, or net margin, is a key indicator of a company’s profitability. It represents the percentage of revenue that remains as profit after deducting all costs, expenses, taxes, and interest:

- A higher net margin indicates that the company retains more profit per dollar of revenue, reflecting its efficiency and profitability.

- Buffett prefers companies with consistently high net margins, as this usually indicates strong competitive advantages (economic moats).

Why Buffett Values Net Margin

- High margins indicate strong pricing power and efficient cost control.

- Stable margins suggest a healthy financial position, enabling companies to withstand market fluctuations.

- Buffett avoids companies with volatile margins, as this may signal an unstable business model or external industry challenges.

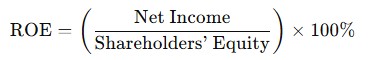

Return on Equity (ROE)

Return on Equity (ROE) is a key financial metric that measures how efficiently a company generates profit using shareholders’ equity:

- A higher ROE means the company generates more profit for every dollar of shareholder investment.

- Buffett highly values ROE, as it reflects a company’s ability to generate returns without relying on excessive external capital.

Buffett’s Criteria for ROE

- Prefers companies with consistently high ROE, as this indicates strong profitability and management efficiency.

- Avoids companies with low or unstable ROE, especially those relying too much on debt to generate returns.

- High ROE companies often possess sustainable competitive advantages and effective capital allocation strategies.

Cash-to-Debt Ratio

The Cash-to-Debt Ratio measures a company’s financial stability by evaluating whether its operating cash flow is sufficient to cover total debt:

- A higher ratio indicates that the company can repay its debts using cash flow from operations, suggesting strong financial health.

- A lower ratio suggests higher financial risk, as the company relies on borrowing to sustain operations.

Why Buffett Focuses on Cash-to-Debt Ratio

Warren Buffett pays close attention to the Cash-to-Debt Ratio because it reflects a company’s financial strength and ability to withstand economic downturns.

- Financial Stability & Solvency – A high cash-to-debt ratio indicates that a company has enough cash to cover its debt obligations, reducing bankruptcy risk.

- Ability to Withstand Economic Downturns – Companies with strong cash reserves and low debt can survive recessions or crises without relying on external financing.

- Lower Interest Expenses – Less debt means lower interest payments, leading to higher net earnings and free cash flow, which Buffett values.

- Financial Flexibility – Companies with high cash-to-debt ratios can reinvest in growth opportunities, acquire competitors, or return capital to shareholders.

- Competitive Advantage – Firms with strong balance sheets can endure tough times better than debt-laden competitors, strengthening their long-term market position.

- Predictability & Consistency – Buffett prefers businesses with stable and predictable financials. A strong cash-to-debt ratio reduces uncertainty in financial projections.

Free Cash Flow Yield

Free Cash Flow Yield measures how efficiently a company converts revenue into free cash flow after accounting for capital expenditures:

- A higher FCF yield indicates that the company is efficient in generating cash, which can be used for dividends, share buybacks, debt repayment, or reinvestment.

Buffett’s Preference for Free Cash Flow

- Prioritizes companies with strong and growing free cash flow, as it allows for financial flexibility.

- Prefers businesses that don’t need heavy capital expenditures to maintain operations.

- FCF growth signals improved efficiency and long-term profitability.

- Buffett avoids companies with low or declining free cash flow, as this could indicate inefficiencies in cost management and capital allocation.