A Quantitative Approach to Economic Moat Analysis

The Competitive Advantage Index (CAI) is a powerful financial metric designed to quantitatively assess a company’s economic moat—the sustainable competitive advantages that allow it to generate consistent profits and fend off competition. By analyzing 11 key financial ratios, the CAI provides investors with a clear, data-driven measure of a company’s long-term financial strength and resilience.

Unlike subjective analysis, which often relies on qualitative judgments, the CAI delivers objective, quantifiable proof of a company’s ability to maintain superior profitability, operational efficiency, and financial health over time.

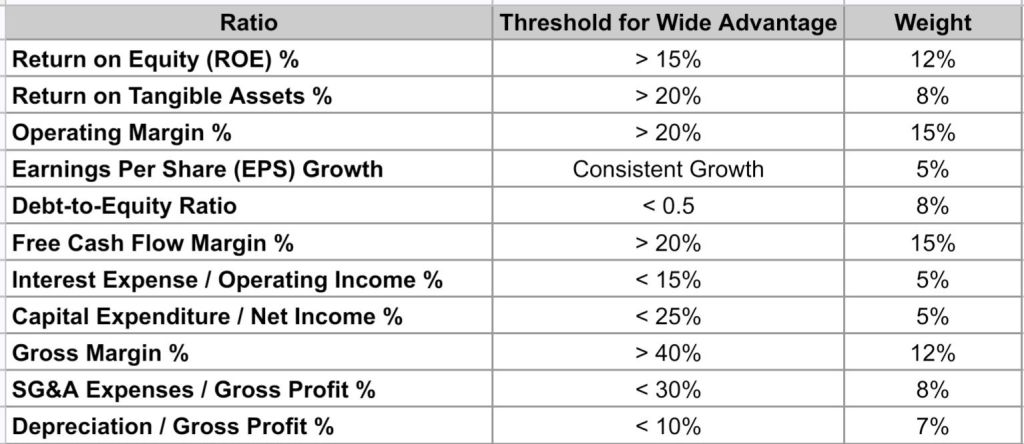

Key Ratios & Weighting

The CAI is calculated using a weighted scoring system based on the following 11 fundamental financial metrics:

Each company’s CAI score is calculated based on its ability to meet or exceed these thresholds. A final score between 0 and 100 places the company into one of four categories:

- Wide Advantage (76–100) – The company exhibits strong and sustainable competitive advantages.

- Moderate Advantage (51–75) – The company has some competitive strengths but may face challenges maintaining them.

- Narrow Advantage (26–50) – The company has limited competitive advantages and may struggle to sustain profitability.

- None Advantage (0–25) – The company lacks meaningful competitive strengths.

Use Cases of CAI in Investment Decision-Making

1. Identifying Wide Moat Companies for Long-Term Investment

Investors following Warren Buffett’s philosophy of investing in durable businesses can use CAI to screen for companies with strong economic moats. A high CAI score (76+) indicates that the company has maintained strong financial ratios over time, making it a prime candidate for long-term investment.

2. Risk Assessment for Portfolio Management

A low CAI score (below 50) signals potential financial weaknesses, helping investors avoid companies with declining profitability, high debt burdens, or weak cash flow generation. This quantitative approach can act as an early warning system to mitigate risk in an investment portfolio.

3. Sector-Based Comparative Analysis

The CAI enables industry-wide benchmarking, allowing investors to compare a company’s financial strength against its competitors. For instance, an investor analyzing the Health Technology sector can assess whether a company like Novo Nordisk has a wider moat than its peers by looking at its CAI score relative to others in the industry.

4. Enhancing Quantitative Research in Economic Moat Analysis

Many investors rely on qualitative assessments of economic moats (e.g., brand power, network effects, cost advantages). The CAI complements these evaluations by offering a quantitative, data-driven confirmation of a company’s moat, reducing the risk of subjective bias.

5. Screening for Value and Growth Stocks

- Value Investors can use CAI alongside valuation metrics to identify undervalued companies with strong moats.

- Growth Investors can track companies with consistently increasing CAI scores, signaling improving financial strength.

Conclusion

The Competitive Advantage Index (CAI) is a revolutionary tool for quantitative economic moat analysis, allowing investors to make more informed, data-backed investment decisions. By systematically evaluating a company’s financial strength across 11 critical ratios, CAI eliminates subjectivity and provides clear, numerical proof of a company’s competitive advantage.

Whether you are a long-term investor, portfolio manager, or quantitative analyst, integrating CAI into your investment strategy will help identify financially superior companies, mitigate risks, and maximize returns.