Therefore, the way of warfare has no fixed form, just as water has no fixed shape. If one can adjust tactics according to the enemy’s movements, they can be considered a master of warfare.

The Art of War : Weak Points and Strong

This strategy is also highly applicable to stock investing, highlighting the importance of flexibility and sensitivity to business intelligence. One of the key reasons Buffett has achieved long-term success in the stock market is his deep understanding of business intelligence and his ability to adjust investment strategies based on changing information. Although Buffett’s portfolio is primarily built on long-term holdings, he does not blindly hold stocks indefinitely. When he discovers that a company has lost its initial competitive advantage, he decisively sells its shares.

In his 1986 shareholder letter, Buffett publicly stated that he would hold three stocks permanently, one of which was ABC. However, after Disney acquired ABC, the company became too large, preventing Disney from focusing on ABC’s development. As a result, ABC’s long-term competitive advantage weakened rapidly. Once Buffett recognized this shift, he decisively sold all his ABC shares.

Although Buffett advocates long-term stock holding, this does not mean holding onto stocks unconditionally. Investors should actively track the companies in their portfolios and closely monitor any intelligence related to those companies. If the information reveals that a business has lost its competitive advantage or its fundamentals have deteriorated, investors should make decisive adjustments, including selling the stock. Buffett always maintains a high level of vigilance in his investments—whenever conditions change, he promptly adjusts his strategy to respond to shifts in the market and the companies he invests in.

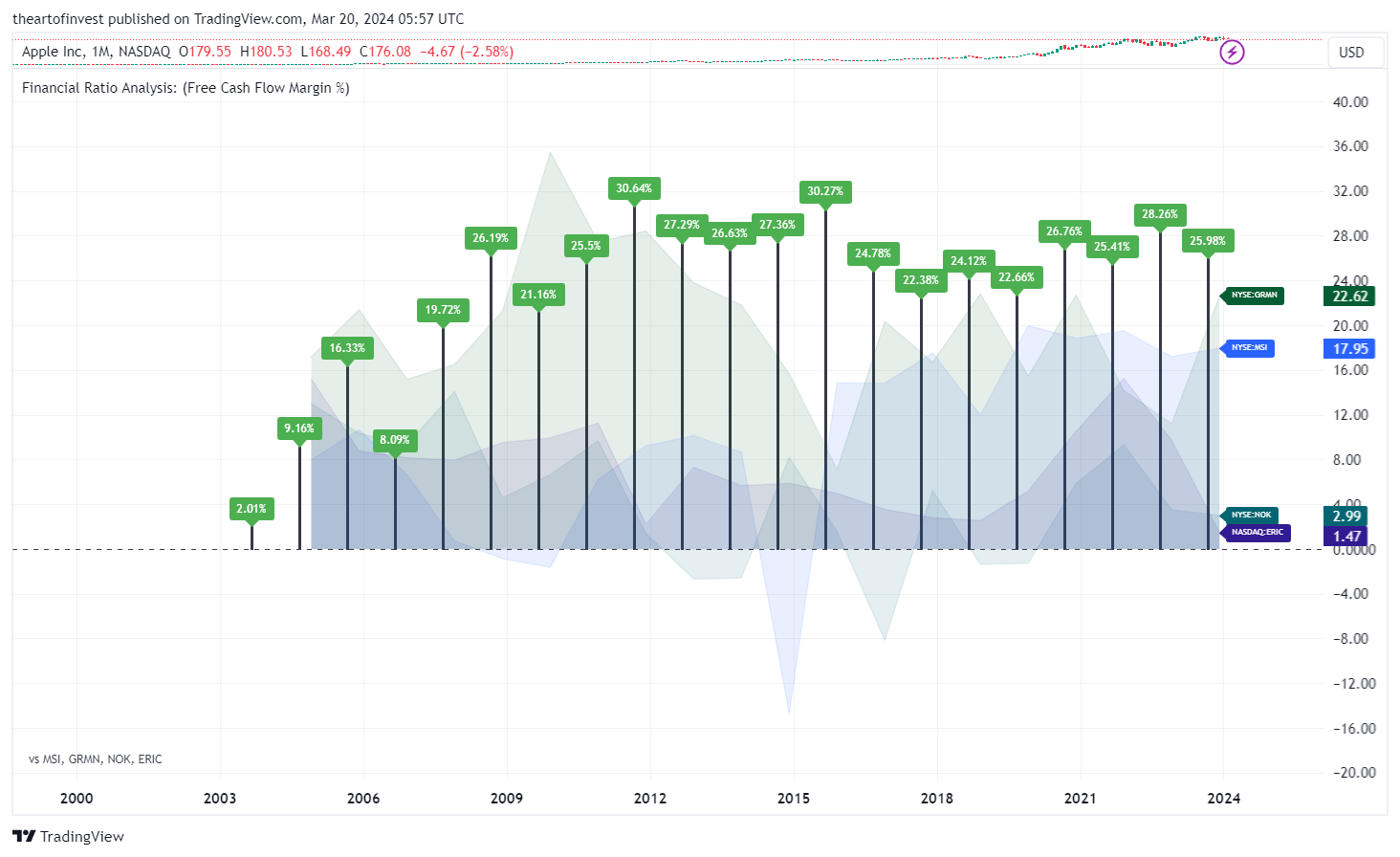

Since 1988, Buffett has never wavered in holding Coca-Cola stock. During this period, Coca-Cola experienced performance declines, such as in 1997 when its return on assets was 56.6%, dropping to 42% in 1998, and further to 35% in 1999. Many investors sold Coca-Cola shares at that time, but Buffett remained confident in Coca-Cola’s unique competitive advantages and never sold its stock. However, he also continued to closely monitor any intelligence about Coca-Cola to ensure that its competitive advantage remained intact. Buffett once said: “If I find that Coca-Cola has not actively developed in the bottled water sector, I will write a letter to its headquarters urging them to make this change. If this suggestion is ignored for years, and as global consumption shifts from soda to bottled water, even a century-old stock like Coca-Cola should be sold.”

Even if a company retains its competitive advantage, Buffett will still sell its stock if another company with the same advantage offers a more attractive valuation. For example, in 1997, he sold most of his McDonald’s shares and instead bought stock in another fast-food company based on a relative value comparison.

Both The Art of War and Buffett’s investment philosophy emphasize the critical role of intelligence. The Art of War states that intelligence determines the outcome of battles, and the same principle applies to investing. Buffett once said,

Risk comes from not knowing what you are doing.

Warren Buffett

His deep research into every investment allows him to make wise decisions even in uncertain markets. Before entering the market, investors must conduct thorough research to understand a company’s fundamentals, market trends, and potential risks. Having this knowledge enables investors to remain calm during market fluctuations and make rational, long-term decisions.

Furthermore, Buffett’s investment strategy strikes a balance between adaptability and long-term holding. While he advocates holding stocks for the long term, this does not mean being stubbornly inflexible. Instead, his long-term holdings are based on continuously monitoring a company’s competitive advantage. Investors should understand that flexibility does not mean frequent trading but making decisive adjustments when a company’s fundamentals undergo significant changes. This balance helps investors avoid missing long-term gains due to short-term market fluctuations.

Buffett also emphasizes the concept of moats, which refers to a company’s unique competitive advantages. For example, Coca-Cola’s brand, network effects, and cost structure create a strong moat. Although the company experienced short-term performance declines, Buffett remained confident in its moat and continued holding its shares. Investors should learn to identify a company’s moat and be ready to make adjustments if that moat shrinks or disappears.

In summary, Buffett’s investment philosophy aligns closely with The Art of War’s strategic principle of “adapting to the enemy’s changes to achieve victory.” He not only advocates long-term investment in high-quality companies but also emphasizes the need to adapt to shifts in the market and businesses. Investors should learn from Buffett’s philosophy: only through adaptability, in-depth research, and rational decision-making can they achieve success in the ever-changing stock market.