Using the conquered foe to augment one’s own strength.

The Art of War : Waging War

In The Art of War, the concept of “Using the conquered foe to augment one’s own strength” emphasizes leveraging captured resources after victory to strengthen one’s own position. In the stock market, when investors profit from their investments, they should reinvest those gains into acquiring more high-quality companies. This strategy enables them to generate even greater profits and steadily expand their investment portfolio.

This approach closely aligns with Warren Buffett’s investment philosophy. Buffett advocates reinvesting corporate earnings through retained earnings or the power of compounding, allowing the initial investment to continuously grow and ultimately build a stronger portfolio.

A company’s profits can be distributed to investors in two ways: one is by returning profits to shareholders through dividends, and the other is by retaining earnings for reinvestment to enhance the company’s intrinsic value and profitability. As the company reinvests and grows, its intrinsic value increases, making the stocks held by investors even more valuable.

Investing is like rolling a snowball

The “snowball” theory is Warren Buffett’s strategy of “Using the conquered foe to augment one’s own strength”. This theory can be summarized as: let your investment principal grow like a snowball. The core of the snowball theory is long-term investment and long-term holding.

Buffett said, “Investing is like rolling a snowball. The important thing is finding wet snow and a really long hill.” In a speech at the University of Nebraska on October 10, 1994, Buffett stated, “Compound interest is like rolling a snowball down a hill. At first, the snowball is small, but as long as it rolls long enough and sticks tight, the snowball will become larger and larger.”

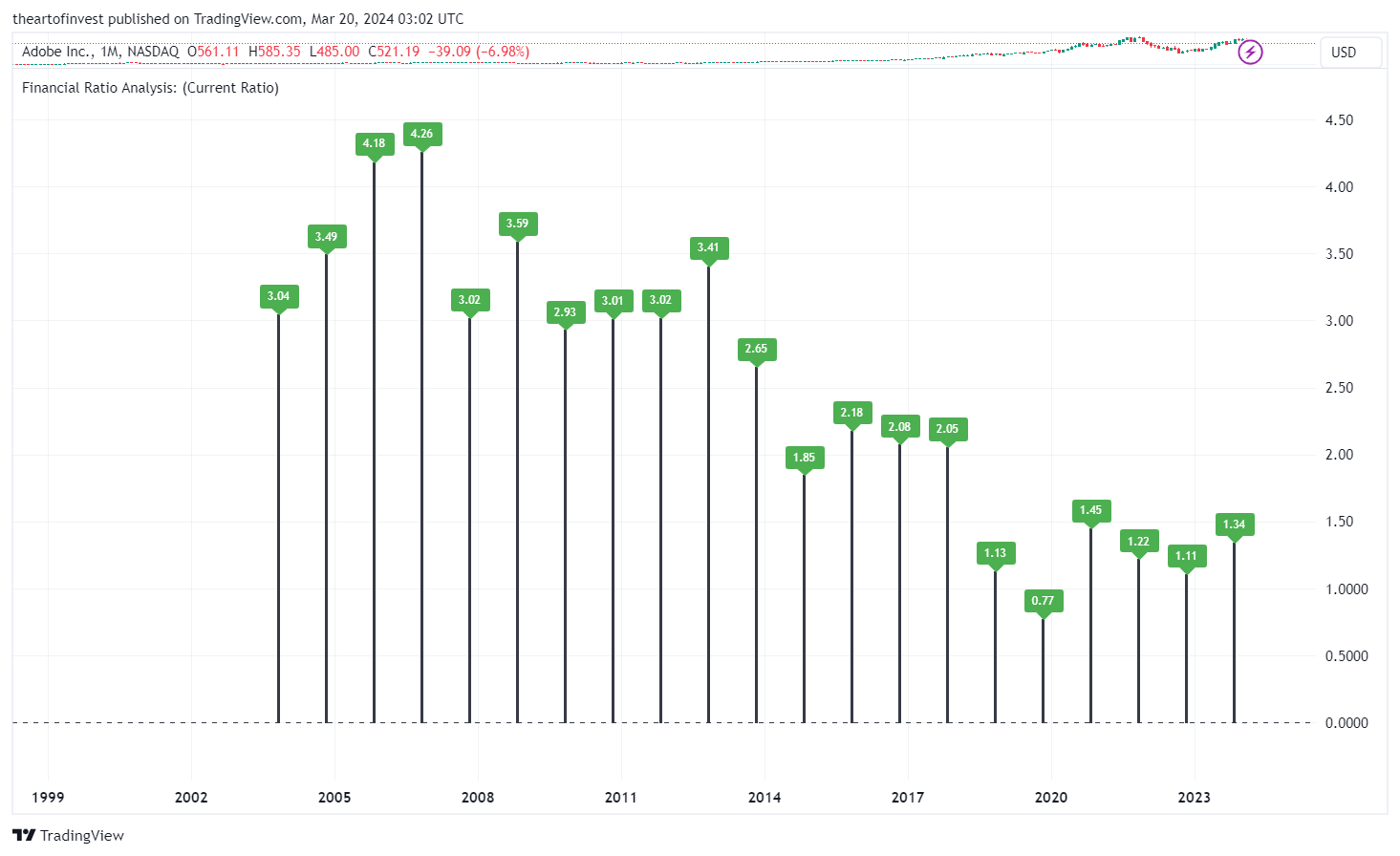

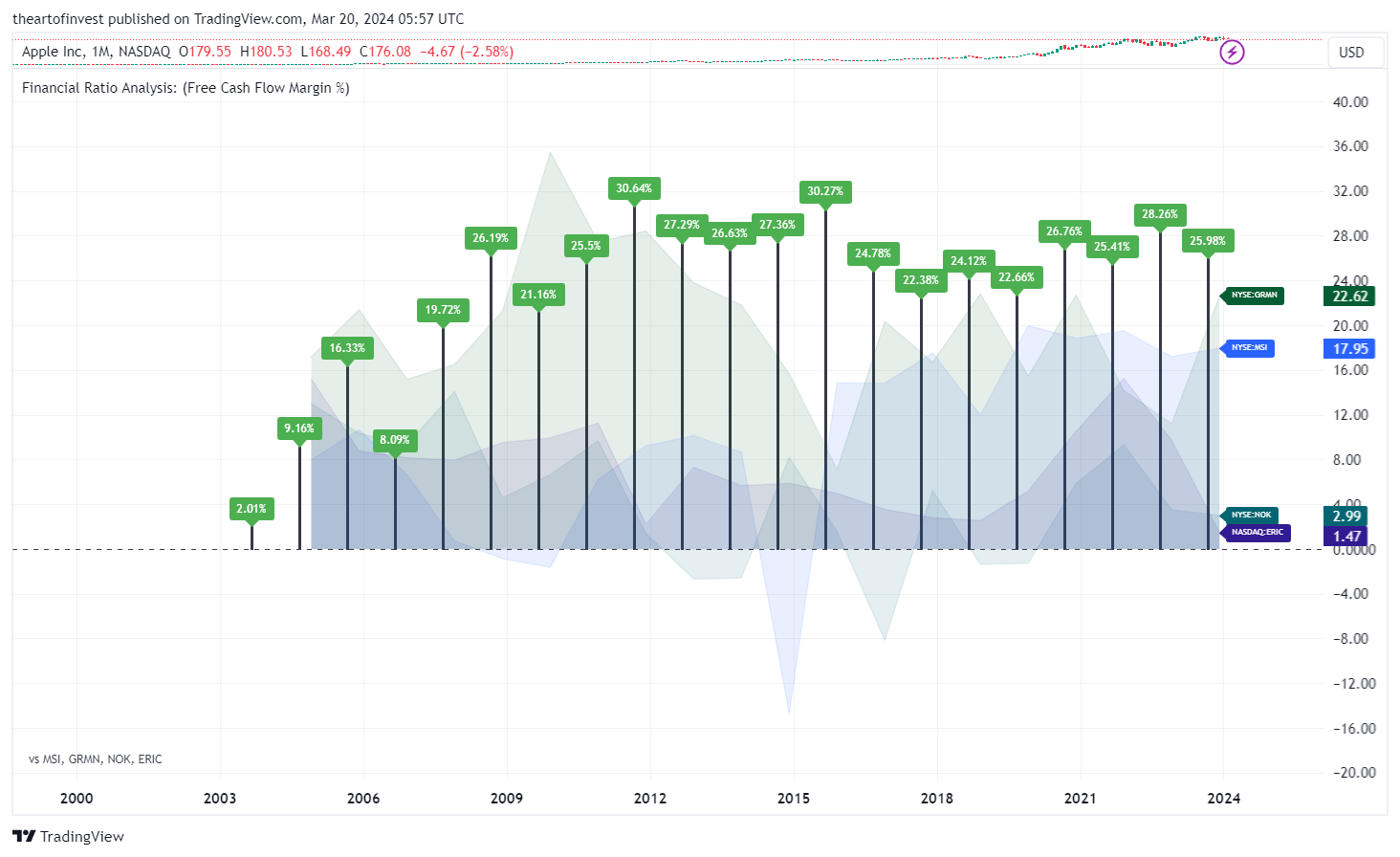

Buffett uses the snowball analogy to describe the accumulation of wealth through the long-term effects of compound interest. In his snowball theory, the snow needs to be wet enough to stick, and the hill needs to be long enough for the snowball to grow bigger. To make your investments grow like a snowball, you need to find companies with high annual returns, or companies with strong cash-generating ability, and use the long-term compounding effect to grow your assets.

Compound interest is essentially earning interest on interest. By reinvesting both the principal and the earnings from previous investments as the principal for the next investment, the principal increases with each investment. The formula for compound interest contains a powerful mathematical amplification effect. Although each increase in earnings might seem small, over time, the numbers can become astonishingly large.

Buffett’s snowball theory emphasises the importance of long-term investment, high-quality investments, reinvestment of earnings, and the compound interest effect. By selecting quality companies, holding them persistently, and patiently waiting, investors can grow their investment principal like a snowball, ultimately achieving outstanding investment returns. Buffett believes that time is a friend to quality companies, not an enemy. He has stated that he will never sell his major stocks, even if their market prices are extraordinarily high. These companies, including Coca-Cola, American Express, and Gillette, provide Buffett with a steady stream of cash flow, which he uses to purchase other high-return quality stocks, thereby continually expanding his investment portfolio.

Classic Investment Case: Coca-Cola

In 1988, Warren Buffett began investing in Coca-Cola, purchasing 7% of the company for approximately $1.3 billion. He chose Coca-Cola because he recognized its powerful global brand and stable cash flow.

Despite experiencing stock fluctuations in the following years—particularly during the late 1990s tech boom, when some investors sold off their shares—Buffett remained steadfast in holding the stock.

Coca-Cola’s strong profitability has provided Buffett with a steady stream of dividends, which he has reinvested into other high-quality businesses, further expanding Berkshire Hathaway’s investment portfolio. Today, Coca-Cola remains a cornerstone of Buffett’s portfolio, serving as a testament to his “Snowball Theory” in action. Through long-term holding and the power of compounding, Buffett’s investment in Coca-Cola has grown many times over, delivering extraordinary returns over the decades.

Investment Case: American Express

In 1964, Warren Buffett invested in American Express at a time when the company was facing a major credibility crisis. Due to the “Salad Oil Scandal,” American Express stock was heavily sold off, as many investors feared for its financial stability and rushed to exit their positions.

However, Buffett saw long-term value in the company and recognized its competitive advantages. He believed that American Express’ credit card business had massive growth potential, and its brand recognition was unmatched globally.

Taking advantage of the market’s pessimism, Buffett bought a significant stake in American Express at a discounted price and held onto his shares for decades. As global consumer spending and financial services expanded, American Express continued to grow, delivering substantial returns for Buffett.

This case highlights Buffett’s ability to identify a company’s intrinsic value, invest boldly during market downturns, and hold quality businesses long enough to reap significant rewards from their long-term growth.

Investment Case: Wells Fargo

Wells Fargo is another classic investment case in Buffett’s portfolio. In 1990, Buffett made his first purchase of Wells Fargo stock when the bank was suffering from a severe real estate crisis that had caused its stock price to be deeply undervalued.

Despite the challenges, Buffett recognized the bank’s strong management team and long-term profitability potential. He believed that its fundamentals remained solid and took the opportunity to acquire a significant stake at a low price.

Over the following decades, Wells Fargo not only recovered but became one of the most profitable banks in the US. Buffett’s decision to hold the stock for the long term led to massive returns, which he then reinvested into other high-quality businesses.

Through the Wells Fargo investment, Buffett once again demonstrated his “using the conquered foe to augment one’s own strength” strategy. He capitalized on market pessimism, acquired a high-quality business at a discount, and allowed compounding returns to build lasting wealth.

Buffett’s “Snowball Theory”: The Power of Compounding & Long-Term Investing

Buffett’s investment success can be attributed to his mastery of compounding and long-term investing. He consistently reinvests investment gains to expand both the size and quality of his portfolio—just as The Art of War suggests:

“Using the conquered foe to augment one’s own strength.”

Rather than chasing short-term market trends, Buffett remains calm, patient, and opportunistic. His investments in Coca-Cola, American Express, and Wells Fargo have all reinforced his snowball strategy, proving that reinvesting profits accelerates portfolio growth and delivers long-term wealth to Berkshire Hathaway shareholders.

Buffett’s “Snowball Theory” is not just a simple investment method—it embodies patience, strategic thinking, and disciplined execution. The key is to identify the right companies, hold them long-term, and let compounding work its magic.

Just as The Art of War states, strengthening one’s position over time is the key to securing greater victories in the future.