Thus, what enables the wise sovereign and the good general to strike and conquer, and achieve things beyond the reach of ordinary men, is foreknowledge.

The Art of War : The Use of Spies

In The Art of War, Sun Tzu emphasizes that “foreknowledge” plays a critical role in success and is the secret to all victories. What is “foreknowledge”? According to Sun Tzu, “foreknowledge” is not the mythical ability to foresee the future, but rather the ability to “know in advance” the opponent’s situation, movements, and deployments. By thoroughly understanding the opponent, one can make corresponding strategies and decisions that lead to victory in war. Sun Tzu believes that wise rulers and capable generals achieve remarkable success not because of their supernatural military skills, but because they have gained early knowledge of their opponent’s information.

Sun Tzu argues that obtaining accurate intelligence is the key to victory. In war, intelligence can provide significant advantages, but the prerequisite is that decisions must be based on the correct analysis of that intelligence. Moreover, the intelligence gathered must be accurate and valuable.

Foreknowledge cannot be obtained from ghosts and gods, nor by analogy from events, nor by calculation. It must be obtained from people who know the enemy’s situation.

The Art of War

To obtain intelligence, one cannot rely on divine intervention, cannot use analogies or assumptions, and cannot verify it through celestial observations; it must be gathered from those who are knowledgeable about the enemy.

Thus, obtaining accurate and useful intelligence, and making the correct analysis of the information gathered, enables one to make advantageous decisions and gain an edge in war.

In stock market investments, those who consistently make long-term profits and create immense wealth through stock investments do so not because they are favored by Lady Luck or possess extraordinary investment skills, but because they know how to collect useful information and make favorable investment decisions based on the correct analysis of that information.

Warren Buffett, one of the most successful investors today, is a prime example of how to gather, analyze, and then make investment decisions based on intelligence. Before making any investment, Buffett places great importance on gathering and analyzing intelligence, especially regarding company operations. He believes that the key to successful investing lies in the in-depth collection and analysis of information about a company’s operations.

Gathering Intelligence from Financial Reports

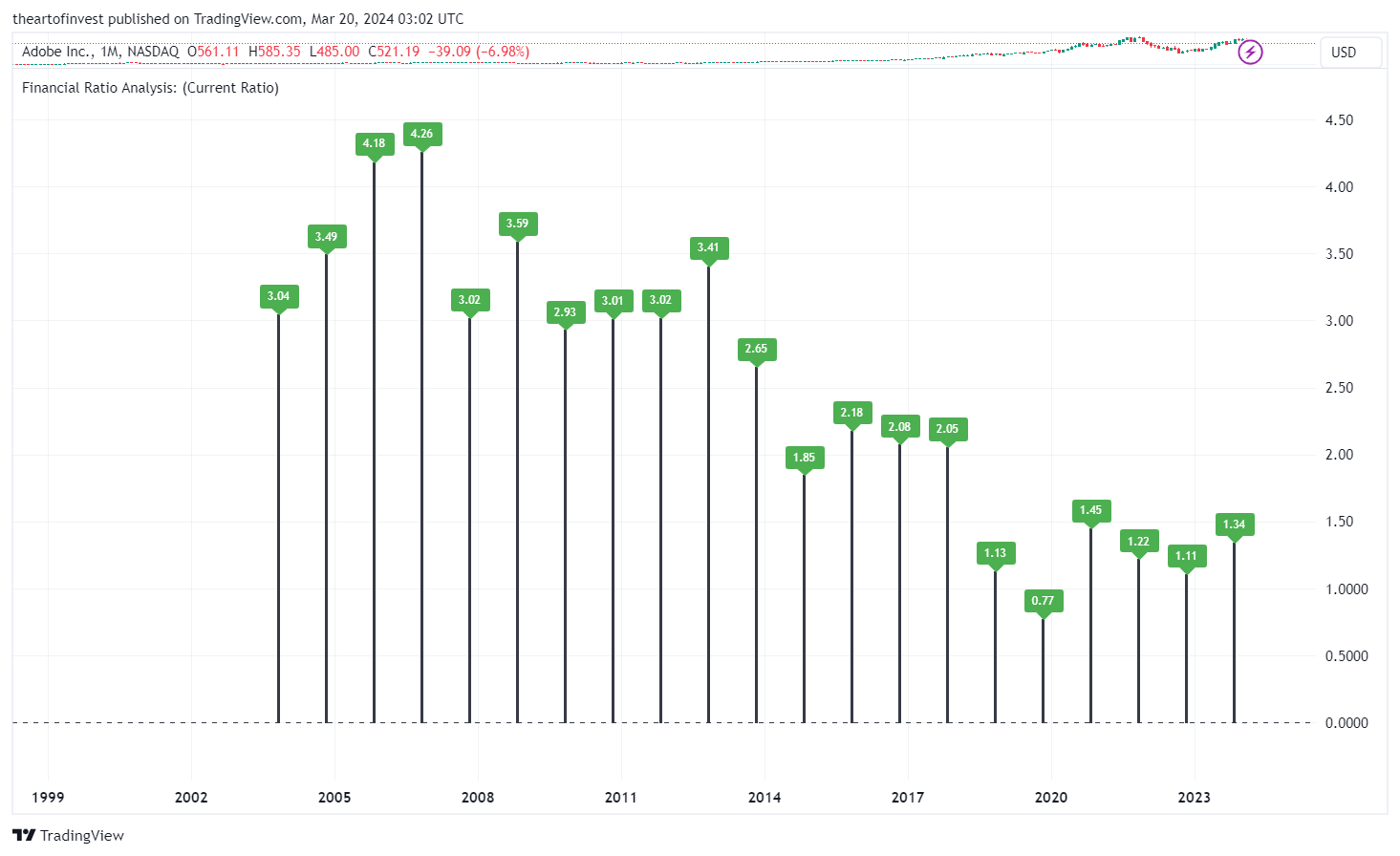

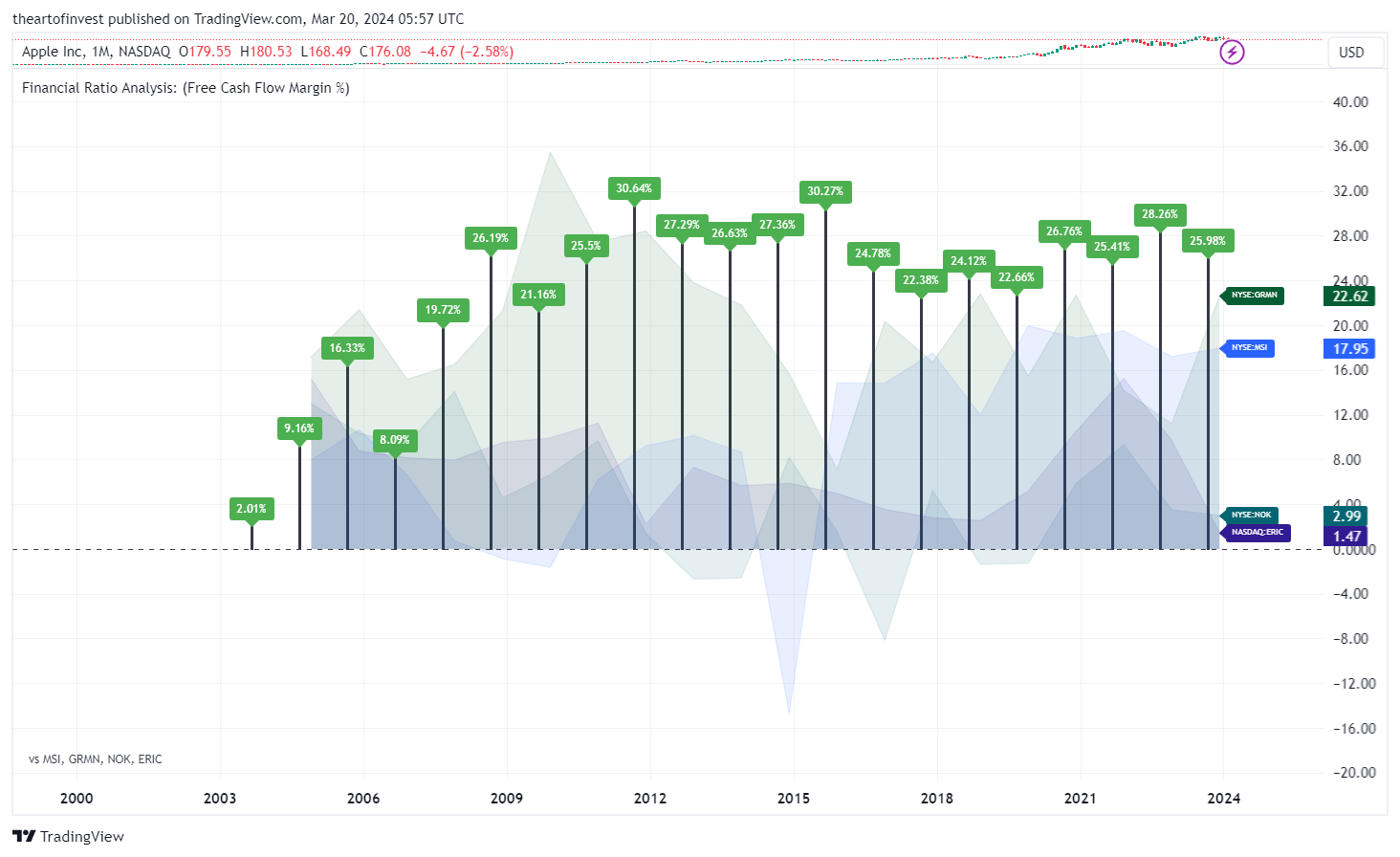

Buffett’s main source of intelligence comes from company annual reports and financial statements, particularly the chairman’s letter, management’s discussion and analysis, and the cash flow statement. These documents provide crucial information about a company’s operational status and future outlook. Over the years, reading annual reports has become a habit for Buffett. He spends considerable time reading and analyzing these reports to obtain comprehensive information about a company, which serves as the foundation for his decisions.

I read annual reports of the company I’m looking at and I read the annual reports of the competitors – that is the main source of material.

Warren Buffett

For instance, when Buffett invested in Coca-Cola, he carefully studied the company’s annual reports and financial statements, discovering its strong brand value and stable cash flow. Through this intelligence, he understood Coca-Cola’s leading position in the global market and its extensive distribution network, which led him to boldly purchase a large amount of Coca-Cola stock in the early 1990s. This decision brought him significant returns, proving his deep understanding of the company’s financial health and his ability to seize market opportunities.

Gathering Intelligence from News Reports

Buffett also places great importance on corporate news reports, which typically cover important company events such as acquisitions, mergers, product launches, and financial reports. During the 2008 financial crisis, Buffett learned from news reports that several well-known financial firms, such as Goldman Sachs, were in distress and urgently needed substantial funds to maintain operations. Through analysis and understanding, he decided to invest in these struggling companies at that time, thereby obtaining favorable terms and discounted stock prices.

In addition, Buffett monitors industry trends and competitor activities. Understanding industry trends helps him assess a company’s market position and prospects. For instance, when he noticed the renewable energy trend in the energy industry, he foresaw the future growth potential of this sector, leading him to increase his investments in related companies.

Gathering Intelligence from Everyday Life

Intelligence does not necessarily come from conventional financial reports or research papers. In fact, valuable insights can be found everywhere in daily life—the key is whether investors are skilled at observing and extracting useful information. For instance, by paying attention to the stores you frequently visit and noting which brands are commonly used by you and those around you, you can identify which products are the most popular and well-received. The companies behind these brands are often worth considering for investment.

Warren Buffett has a deep understanding of this principle. He often discovers potential investment opportunities through keen observations of everyday life.

One classic example of this approach is Buffett’s investment in Coca-Cola. As a consumer, he noticed that Coca-Cola was not only widely popular in the U.S. but also had strong brand recognition and loyalty worldwide. No matter where he went, people enjoyed drinking Coca-Cola. This gave him confidence that the company had long-term growth potential. As a result, he decided to purchase a large amount of Coca-Cola stock and has held onto it ever since. Buffett valued not only Coca-Cola’s financial performance but also its irreplaceable position in people’s daily lives and its continuously growing brand influence.

Another example is Buffett’s investment in See’s Candies. Through everyday observations, he discovered that this candy company had a strong reputation on the West Coast, particularly during holidays when its products were in high demand. Buffett noticed that people were willing to pay a premium for See’s high-quality products, demonstrating strong brand loyalty. This convinced him that the company had a “moat,” or a durable competitive advantage. He quickly invested in See’s Candies and continues to regard it as a great investment.

Buffett’s investment in American Express is another case that illustrates the power of everyday observations. In the 1960s, American Express was hit by the “Salad Oil Scandal,” causing its stock price to plummet. However, Buffett observed that despite the financial turmoil, consumers and businesses still trusted and relied on American Express cards—especially among high-end clientele and corporate users. Based on this insight, he believed that the company’s core business remained strong. He took advantage of the low stock price to buy a significant amount of American Express shares, ultimately reaping substantial returns.

Similarly, Buffett’s investment in Apple stemmed from his observations of modern lifestyles. He recognized that Apple products, especially the iPhone, had become an essential part of people’s daily lives. Whether for work, socializing, or entertainment, an increasing number of people depended on Apple’s devices and services. This deep level of user engagement gave Buffett confidence. Despite his initial reservations about tech stocks, Apple’s strong brand and user loyalty led him to change his stance, and he eventually became a long-term investor in the company.

Another excellent example is Buffett’s 2007 investment in PetroChina. Observing China’s rapidly growing energy demand, he became interested in the company’s future prospects. After thoroughly analyzing PetroChina’s financials and market outlook, he decided to invest, later achieving significant profits.

These examples demonstrate how Buffett has successfully identified valuable investment opportunities by observing consumer behavior and product trends in everyday life. This type of intelligence is often more intuitive and reliable than simply relying on financial data, as it reflects real market demand and consumer habits. Therefore, investors should learn from Buffett and pay attention to the details of daily life. By observing which brands and products are widely used and favored by consumers, they can identify companies with long-term competitive advantages that are worth investing in.

Over his decades-long investment career, Buffett has built a diversified portfolio that includes gas stations, farms, textile mills, major retailers, banks, insurance companies, newspapers, oil companies, and cable and wireless TV companies. Whether he holds decision-making power or is simply a shareholder, Buffett thoroughly understands the operations of the businesses he invests in.

He continuously monitors key aspects such as annual revenue, expenses, cash flow, labor relations, pricing flexibility, and capital allocation. By analyzing these factors, he makes informed investment decisions. This meticulous approach to gathering and analyzing intelligence about the companies he invests in is one of the key reasons for his long-term success. As the investment strategy proverb states, “foreknowledge leads to extraordinary success.”