Now the general who wins a battle makes many calculations in his temple ere the battle is fought. The general who loses a battle makes but few calculations beforehand. Thus do many calculations lead to victory, and few calculations to defeat: how much more no calculation at all! It is by attention to this point that I can foresee who is likely to win or lose.

The Art of War : Laying Plans

Sun Tzu’s concept of “calculation” does not mean analyzing everything indiscriminately, but rather focusing on the key factors and conducting targeted analysis. Only by doing so can one effectively improve the probability of victory.

Warren Buffett is one of Benjamin Graham’s most esteemed students, and his investment philosophy inherits the essence of Graham’s teachings. Buffett’s mentor once taught him: “To succeed in investing, the first rule is to avoid losing money.” This lesson had a profound impact on Buffett, making him deeply aware of the importance of preserving capital. As a result, he always conducts detailed analysis and calculations before formulating cautious investment plans and never makes rash investment decisions.

In stock investing, Buffett’s calculations and analyses focus on two key aspects: evaluating a company’s operational performance to identify high-quality businesses and calculating the company’s intrinsic value. He then patiently waits for the right opportunity to buy the stock at a reasonable price. Buffett believes that a smart investor only needs to excel at two things: stock selection and valuation.

Stock selection: Identify high-quality companies with sustainable competitive advantages.

Valuation: Calculate the intrinsic value of the company and buy it at a price lower than its intrinsic value.

Stock Selection

For Warren Buffett, investing in stocks is synonymous with investing in businesses. His method of stock selection is therefore deeply rooted in a thorough analysis of the underlying company’s fundamentals, business model, and financial health. Buffett assesses whether a company possesses a strong competitive advantage and the ability to generate consistent profits by understanding its core competencies.

Buffett’s analysis doesn’t stop at the company level; he also closely examines the financial information, strengths, and weaknesses of its competitors. This comparative analysis ensures that the company he invests in is a leader within its industry, offering a better chance of long-term success.

Focus on Business Fundamentals

Buffett believes that investors should concentrate on understanding a company’s operational performance rather than attempting to predict future stock price movements based on past trends. He famously critiques analysts who rely heavily on technical analysis, comparing them to fortune-tellers who try to predict the future by interpreting patterns in charts. Such “calculations,” according to Buffett, do not genuinely enhance the probability of profitable stock investments.

Key Aspects of Buffett’s Stock Selection Process

- Business Quality:

- Sustainable Competitive Advantage : Buffett looks for companies with a durable competitive advantage, or “economic moat,” that protects them from competitors. This could be due to strong brand loyalty, unique products, or cost advantages.

- Stable and Understandable Business Model : He prefers businesses with stable, straightforward operations that he can easily understand. This reduces the risk of unexpected negative surprises.

- Management Quality:

- Integrity and Competence : Buffett places significant importance on the quality of a company’s management. He seeks leaders who are both competent and act with integrity, ensuring that they will make decisions in the best interest of shareholders.

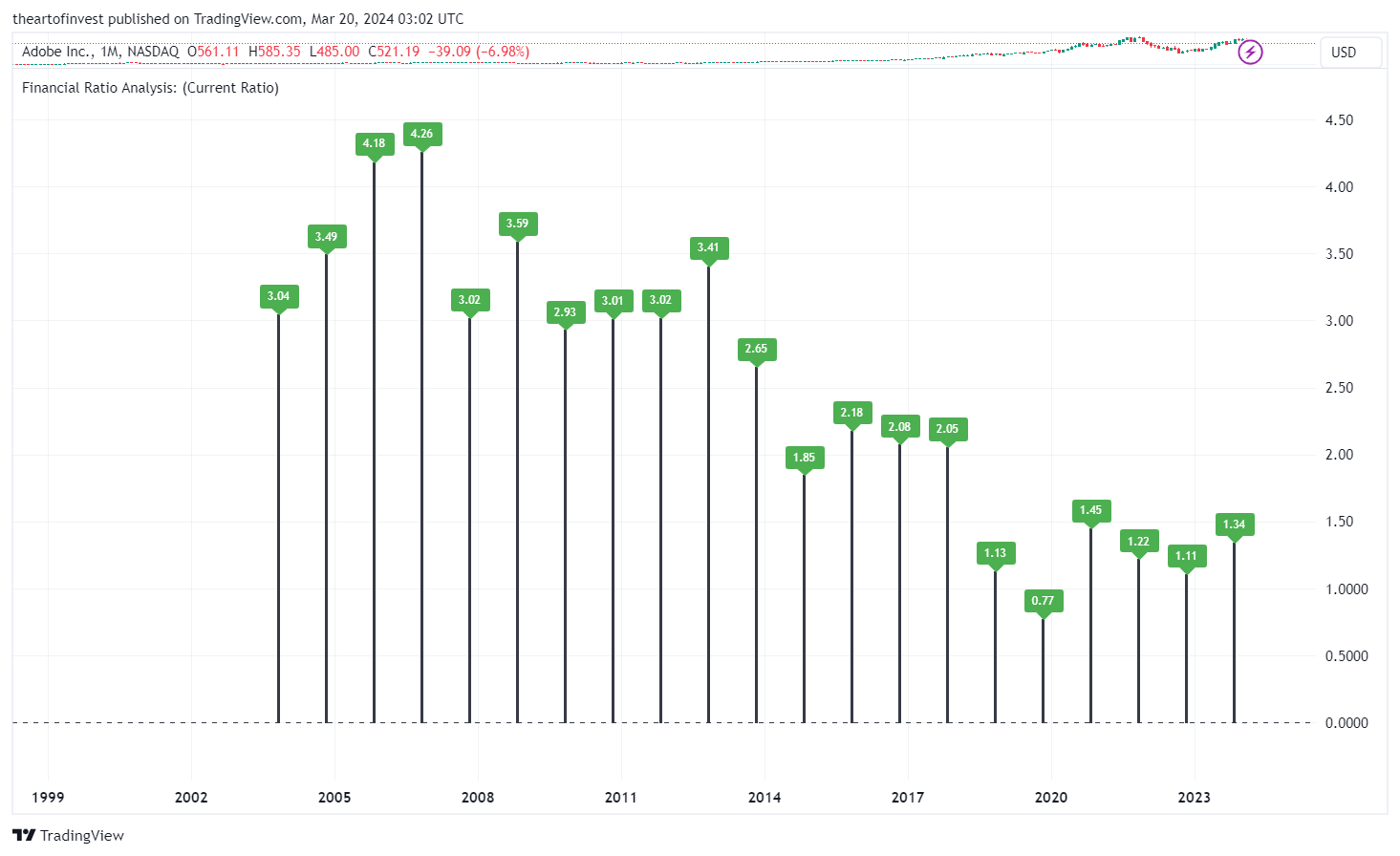

- Financial Health:

- Strong Balance Sheet : Companies with strong balance sheets, low levels of debt, and ample cash flow are preferred, as they are better equipped to withstand economic downturns.

- Consistent Earnings : Buffett values companies that have a history of consistent earnings growth, as this is often indicative of a well-run business with a stable demand for its products or services.

- Industry Leadership:

- Competitive Positioning : By analyzing a company’s competitive positioning within its industry, Buffett ensures that the business is not only strong but also well-placed to dominate its market. This involves a careful study of competitors to confirm the chosen company’s superior standing.

Valuation

After identifying high-quality companies, Buffett’s next step is to estimate their intrinsic value. Only by knowing a company’s intrinsic value can he determine the right price to purchase its stock. Buffett believe that, the more accurate the valuation, the higher the probability of investment success.

So how should investors estimate a stock’s intrinsic value? Buffett has a simple yet effective method: valuing stocks the same way as bonds.

Buffett’s definition of intrinsic value:

“It is the discounted value of the cash flows a business is expected to generate over its remaining lifetime.”

Buffett’s valuation formula involves estimating the expected cash flows a company will generate over a certain period and discounting them at an appropriate rate. This formula is identical for both stocks and bonds. The only difference is that bonds have a fixed coupon payment and a maturity date, allowing investors to clearly determine their future cash flows. In contrast, stock investors must estimate future “coupons” themselves. To Buffett, stocks are essentially bonds with variable interest payments.

While the formula for intrinsic value is relatively simple, predicting a company’s future earnings is extremely difficult. Even experienced analysts make errors in estimating future cash flows, leading to miscalculations in intrinsic value. So how does Buffett minimize valuation mistakes? He follows a straightforward yet effective approach: avoids estimating companies with highly unstable earnings and unpredictable cash flows. Instead, he only selects companies with highly stable and predictable cash flows. These companies typically have simple and steady business models, enduring competitive advantages, and strong economic moats. Buffett explains, “Since these companies have earnings stability similar to bonds, we can apply a bond-like valuation method to assess them.” This principle forms the core of Buffett’s stock selection and valuation strategy.

Thus, in The Art of Invest, the principle “More calculations lead to victory, fewer calculations lead to defeat” applies to evaluating the quality of a business and determining its intrinsic value. Only by calculating in the right areas can investors increase their probability of success.